GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer.Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage.

Introduction of GST would also make Indian productscompetitive in the domestic and international markets. Studies show that thiswould instantly spur economic growth.

GST- What all it includes:Easy and Transparent:

All tax payer services such as registrations, returns, payments, etc. would be available to the taxpayers online, which would make compliance easy and transparent.

Uniform Tax Structure:

GST will ensure that indirect tax rates and structures are common across the country, thereby increasing certainty and ease of doing business in whole country.

Seamless Tax –Credit:

A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would ensure that there is minimal cascading of taxes.

Improve Competitiveness:

Reduction in transaction costs of doing business would eventually lead to an improved competitiveness for the trade and industry.

Advantages to manufacturers and exporters:

The complete and comprehensive set-off of input goods and services and phasing out of Central Sales Tax (CST) would reduce the cost of locally manufactured goods and services. The uniformity in tax rates and procedures across the country will also go a long way in reducing the compliance cost.

Registration:

Existing dealers:

No fresh registration needed forexisting dealers. Existing VAT/Service tax/Central Excisedealer data to be migrated to GST system.

New dealers :

Single application to be filed online forregistration under Goods & Services Tax (GST).The registration number will be PAN based and willserve the purpose for Centre and State.Each dealer to be given unique id GSTIN

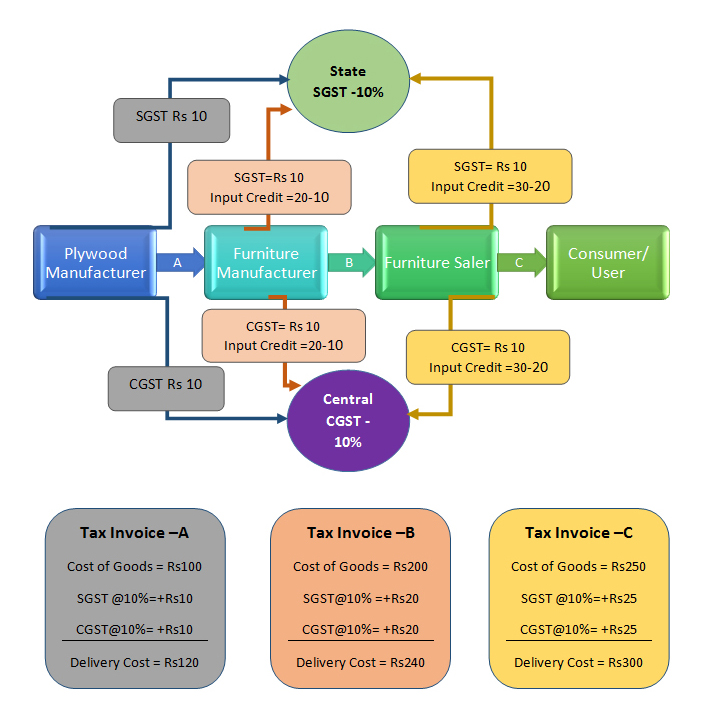

GST Calculation with in State

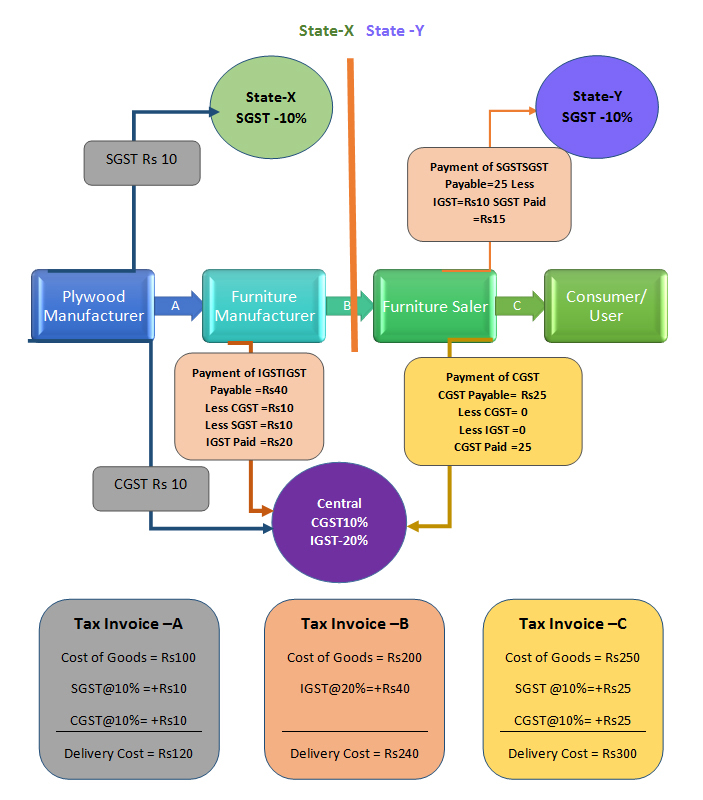

IGST Calculation for inter State

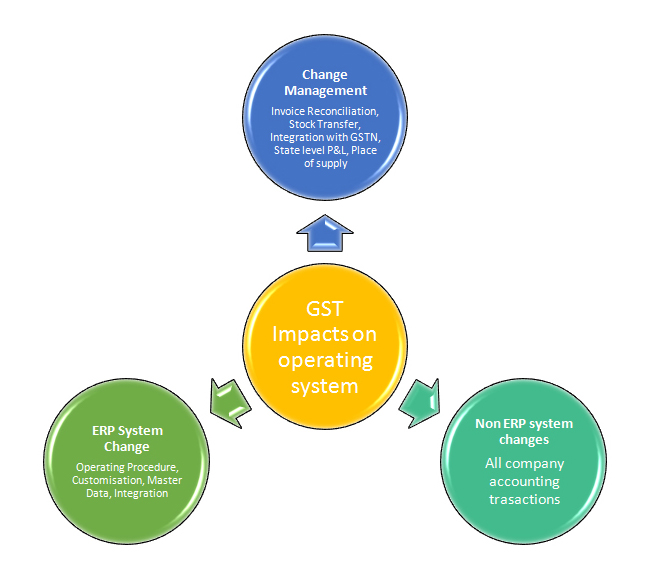

Changes in operating system to incorporate GST

GST implementation, the Central and State Governments have jointly registered Goods and Services Tax Network (GSTN) as a not-for-profit, non-Government Company to provide shared IT infrastructure and services to Central and State Governments, tax payers and other stakeholders.

There would no manual filing of returns. All taxes can also be paid online. All mis-matched returns would be auto-generated, and there would be no need for manual interventions. Most returns would be self-assessed.

Convurt Consulting Services Pvt Ltd

www.convurt.in

info@convurt.in